Electric car production has barely surpassed 1% for several years. Then, as a result of government incentives, many OEMs began to transition production to hybrid and electric vehicles. According to Credit Suisse Global Auto Research, this number will increase from 11% in 2020 to 62 percent in 2030, with 63 million vehicles sold globally. Almost half of these, or 29 million, are expected to be totally electrified.

In an interview, Patrick Wadden, Vicor Global VP of Automotive Business Development, stated that there is a significant investment in electrification, and that power technologies will play a pivotal part in addressing powertrain efficiency challenges.

“ Volvo is claiming that 50% of their vehicles will be electric, and the remaining ones are going to be hybrid by 2025. By 2030, Ford, GM and Chrysler are going to be investing over $50 billion. This year new vehicle estimates are even higher than last year. Out of 63M xEV cars by 2030, we expect battery electric vehicles to account for 29M cars – 45% of the xEV total. ICE vehicle production, according could fall from 97% in 2020 to as low as 10% in 2040,” said Wadden.

Some of the most popular cars are being electrified, including GM Hummers, the new Ford Mach E (electric Mustang), and now the flagship F150 Light-Duty Truck (Lightning). The new cars include improved rapid charging technology as well as decreased maintenance and repair expenses.

Power demands for EVs are increasing up to 20X.

Cars with combustion engines usually have power outputs ranging from 600W to 3kW. Electric vehicles, such as EVs, HEVs, and PHEVs (xEVs), require power levels of 3 to 60 kW, which is more than 5 to 20 times that of conventional vehicles. For electricity engineers attempting to optimize the power distribution network, this rise presents a significant issue (PDN). To address these issues, Wadden stressed the importance of using lightweight and compact systems that are flexible enough to scale and reuse power components across the fleet.

OEMs must boost power levels, reduce powertrain size and weight, and improve thermal management and reusability to maximize vehicle electrification. Powertrain selection and charging arrangements are two of the most complex engineering concerns.

OEMs are working hard to improve their PDN. They are spending millions of dollars on electrification research and development. They are always experimenting with new technology and inventing. 48-volt power supply technology is quickly developing in the automobile market, both for fully electric, hybrid, and mild hybrid vehicles.

Modular advantages in automotive

Whether it’s a fast sports car, a light duty truck, or a family car, OEMs need to pack as much power as possible in a constrained space. “Vehicles need compact and efficient power solutions,” said Wadden. To achieve full fleet electrification, OEMs need to be able to reuse designs across different platforms to speed time-to-market. Automakers have many vehicles using the same platform and easy power scaling is essential when modifying the power between sedans, minivans, SUVs, etc. that share the same platform.

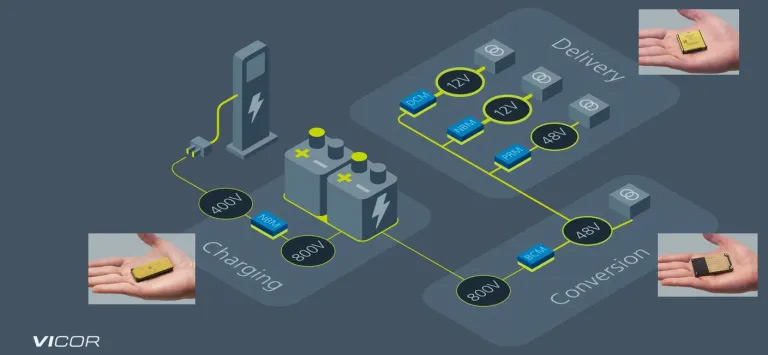

The overall weight of the vehicle has an impact on performance, particularly on battery life. With EMI filtering, a decreased cooling structure, and a 25kg 48-V battery replacement case, Vicor’s 98% efficient bus converter module (BCM6135) may be readily implemented. In a compact 61 x 35 x 7mm size, the high-density power module converts the primary battery from 400 to 800V to 48V, giving over 2kW of power with a power density of >4.3kW/in.3 (Figure 2).

Due to advances in vehicle electrification, power system design teams are faced with the challenge of changing power requirements. Wadden highlighted that the flexible and scalable modular power system design approach allows designers to implement standardized solutions in a wide variety of powertrains such as SUVs, minivans or light trucks.

Modularity also allows distributed power architectures from a 48-V bus. Power modules can be placed in convenient locations for localised 48-V/12-V conversion – behind the glove compartment, near the boot or near each wheel.

Wadden pointed out that one of the most common delays in vehicle development is the qualification and approval of the electronic components used in the vehicle. Sometimes the process can take up to two or three years. The technology of a single, high-density power module makes all the difference by saving design time. “Innovation is needed in the form of new architectures and topologies that provide maximum performance today and can also be reused and reconfigured for the future,” Wadden concluded.

“Integration is important. If you look at one of our modules that has 200 individual components inside, it’s a lot easier to qualify one module than it is 200 components. And so integration has a lot of merit.,” said Wadden.

Many electric vehicles are starting to use 800-V for the primary battery to meet the required power levels and deliver higher performance over 400V batteries. Existing converters are bulky and heavy, precisely because of the high ratio of input-to-output voltage (800V to 48V). With Vicor fixed-ratio conversion modules, which operate at high switching frequencies, efficiencies of 98% can be achieved, thus reducing the size of the system. With a decentralized architecture and with a modular power supply for the distribution of the 48-V power supply, the design can be greatly simplified. The modules can be easily connected in parallel and, with the addition of a few others components, it is possible to create power delivery network from a few hundred watts to tens of kilowatts.

Today the power deilvery nework for EVs is undergoing scrutiny and redesign with great pressure to outpace the competion quickly. Power modules deliver distinct advantages, offering a power dense, flexible and highly efficient approach to power system design.